The caveats surrounding this model are many: it's based on industrial production data (since this is available monthly), and doesn't include information about other variables - notably policy. But for a simple model it has a rather good track record. While the pessimism in the model's forecasts may not be widely shared, these figures do serve to emphasise just how fragile is the recovery.

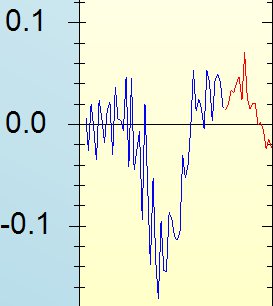

The graph below shows the actual data back to just before the downturn - the forecasts are at the right of the graph (where the line turns red) and look forward 18 months.