Thursday, October 27, 2011

Thirlwall, A. (1980). Regional problems are “balance-of-payments” problems Regional Studies, 14 (5), 419-425 DOI: 10.1080/09595238000185371

a 50% write-down for Greek debt held by private banks

additional finance for the Greek bailout package

the European Financial Stability Fund (EFSF) is to be extended

the EFSF will operate so that 'risk insurance would be offered to private investors as an option when buying bonds in the primary market' - in other words as an insurance

strengthening of the Stability and Growth Pact

changes in governance

The wording of the document is interesting. The 50% haircut is described as an invitation to 'Greece, private investors and all parties concerned to develop a voluntary bond exchange with a nominal discount of 50% on notional Greek debt held by private investors'. The additional financing for the bailout fund is intended to come partly from parties (such as the International Monetary Fund) which have not been party to these negotiations. The first question that needs to be asked about this agreement - the prerequisite for going past first base - therefore, is: will key parties that are being asked to fund this agreement agree to do so?

The proposals surrounding the EFSF are central to the agreement. As BBC broadcaster Evan Davis has tweeted: 'Don't you go to jail for selling insurance when you have no means of paying out?' One might add that premia rise with risk, and when the risk is high the premia could lie outside the reach of even the expanded EFSF. An alternative to leveraging the EFSF in this way would have been to free up the European Central Bank (ECB) as proposed by Charles Wyplosz and Paul de Grauwe. While some observers may be wary of the inflationary implications of quantitative easing by the ECB, inflation is simply not a threat at present. The ECB alone has the capacity to provide all of the funding that the EFSF could conceivably require. The agreement comes up short in this area.

The strengthening of the Stability and Growth Pact - intended to provide fiscal discipline - is a step towards fiscal union, but is likewise timid. After all, the Pact in its original form has failed rather spectacularly. The new agreement issues an 'invitation to national parliaments to take into account recommendations adopted at the EU level on the conduct of economic and budgetary policies'. The EU Commission and Council 'will be enabled to examine national draft budgets and adopt an opinion on them'. The language is a fudge, and past form suggests that it will be treated as a fudge. Likewise, the agreement states that 'national budgets should be based on independent growth forecasts' - and so they should.

The governance of the Euro area also receives much attention in the agreement. There will be regular summit meetings of the 17 member states that have adopted the Euro, these being chaired by a President of the Euro summit. Clearly this forms an inner core of 17 of the 27 EU members, the remaining 10 states being in a periphery. The future political evolution of a two-tier EU will be interesting.

Wednesday, October 26, 2011

Using a similar method for the economy as a whole presents some interesting results. A google trends analysis of 'recession', confining the search to the UK, yields the time series shown in the graph below. This clearly indicates that searches rose in the run-up to the 2008 recession. There is some sign that it is rising again now - though the series is not clear on this, and data from the next few months could see the series go either way. (It is, perhaps, surprising that 'recession' is not trending more strongly given current fears about the state of the economy. Maybe people found out what they needed to know during the last recession, or maybe they are searching for other, related, terms now.)

Language is important. During the 2008 recession, 'credit crunch' trended (see the first graph below), but 'debt crisis' (the second graph) did not. Now the reverse is the case. The terms in which the popular media describe events presumably influence the terms for which people search.

Friday, October 21, 2011

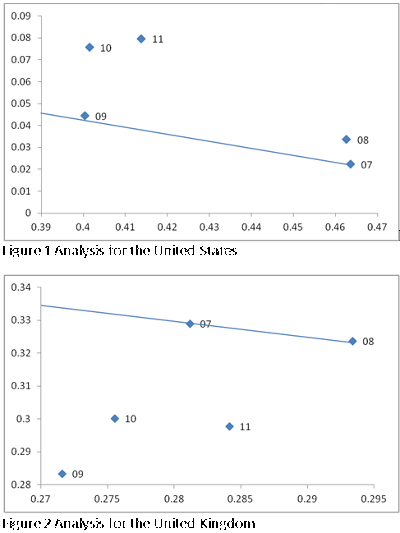

The lines represent the marginal productivity schedules, calculated using Mulligan's method, as observed in 2007. In the US, it appears that the shake-out of labour has not been associated with a fall in productivity. Indeed between 2007 and 2009 there was little change in the position of the marginal productivity schedule. Mulligan interprets this as indicating that the fall in employment over this period was due either to supply side shifts or labour market distortions, rather than to changes in demand. An alternative interpretation is that the impact of the recession fell disproportionately on low productivity workers. In the UK, by way of contrast, the observation for 2009 lies way below the marginal productivity schedule in 2007 and 2008. This may reflect a shake-out of high productivity workers, but it is arguably more likely to reflect the severe drop in demand suffered by the UK economy at this time. In both countries there appears to have been an upward shift in 2010-11 as their economies (temporarily perhaps) recovered.

While the marginal productivity schedule is, by now, higher in the US than it was before the recession, in the UK the schedule still lies well below the pre-recession position. In this country, at least, demand deficiency has been a key factor throughout the last few years - and it remains a problem.

Friday, October 07, 2011

The Bank of England has now announced a new wave of quantitative easing, amounting to a further £75 billion. This is in response to the alarming signs of slowdown in the economy. The announcement is welcome. It is also likely that the Treasury will start to purchase private sector assets as a means of improving the flow of funds, especially to small firms. Since this would represent an investment, it can be done outside the government's self-imposed fiscal limits. This too is welcome - if the free market in financial services is shackled, then such measures would appear to be necessary. The government may not be good at picking winners, but neither is a rapidly re-ossifying financial sector.

Could this expansion prove to be inflationary? There are very few signs that it could. The economy is still a long long way from capacity, and the effect on headline inflation of last year's VAT rise will soon vanish from the figures. Inflation should be the thing of least concern to policy makers at this time.