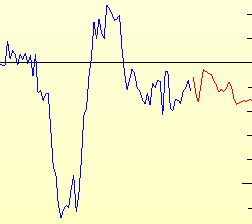

Chart 3.14 on page 100 tells the story. The central projection shows that we can expect the net public sector debt as a proportion of GDP to rise towards 100% by the 2060s. Increasing immigration can reduce this burden quite substantially - since migrants tend to be younger than the population as a whole, and hence are more likely to be working, they generate substantial tax revenues. Reducing immigration has a severe impact on the national debt; indeed reducing net migration to zero is projected to cause the public sector net debt to rise to around 150% of GDP by the 2060s.

It is difficult to place too much credence on figures that look so far into the future. But the overall message from the Office for Budgetary Responsibility is clear: reducing the national debt without accepting an increase in immigration is likely to be an unrealistically tough ask.