Sunday, September 23, 2012

Paul Gregg and Steve Machin have recently examined the way in which the sensitivity of the real wage to unemployment rates has become stronger over the last decade or so. I have noted this in an earlier blog post, though I would argue that the change slightly predated the 2003 point identified by Gregg and Machin.

Whether, as the economy begins to recover, real wage restraint will continue is moot. If wage pressure returns over the next twelve months or so - before the recovery is consolidated - it may well be the case that interest rate hikes will be needed sooner rather than later in order to prevent a stagflation.

Wednesday, September 12, 2012

Thursday, September 06, 2012

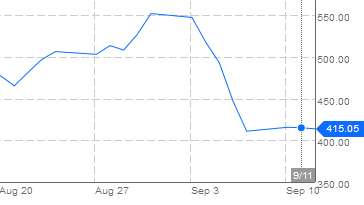

The news that the European Central Bank will pursue outright monetary transactions (OMTs) - purchases of bonds issued by eurozone member countries - as a means of reducing borrowing costs for these countries is very welcome. The conditions under which such transactions will take place remain unclear; the ECB intends to purchase bonds only when it perceives serious distortions to the market, where these distortions are based on what it deems to be unfounded fears. Moreover, the ECB's intervention will be conditional upon the action being part of the European Stability Mechanism, making the availability of such support dependent on countries' compliance with fiscal discipline requirements. This last condition is critical, but the binary nature of any judgement about compliance means that pressure will inevitably come to bear in instances where the judgement is marginal. A better solution would be to offer support on a sliding scale, making support more costly where discipline is weaker. This would effectively be the solution offered by conditional bonds.

Nevertheless, the new initiative is a major step forward. It had been anticipated by the markets - the interest rate spreads for countries such as Spain and Italy had already fallen dramatically over the last day or so. In itself, this is a welcome outcome, though the spreads still have a long way to fall.

Subscribe to:

Posts (Atom)