Friday, December 28, 2012

Wednesday, December 05, 2012

A major difficulty over the last two years has been the continued weakness of the Eurozone. This has hit growth, and consequently had an adverse effect on tax receipts.

Taxpayers know that the deficit must be paid off sometime. The trick is to phase the austerity measures in such a way that, in time, they result in a reduced burden of debt, while not choking off the growth that is essential to the repayment of that debt. Current forecasts suggest that it will be the latter half of next year before any significant growth resumes, and this makes the balancing act particularly difficult. In this context it is particularly important that fiscally neutral changes in tax and government spending should be tilted to favour growth - this means that the raising of tax allowances and the investments in infrastructure are both to be welcomed.

Meanwhile, the statement points to the spending review that is to take place in the first half of 2013. The plans for deficit reduction, and specifically for government spending, in this statement indicate that the review will need to take a draconian stance. The extent to which that turns out to be feasible in practice will depend heavily on the broader macroeconomic context. If the European economy remains fragile beyond 2013, further fiscal retrenchment at home is likely to prolong still further the return to significant levels of growth. Indeed, the extent of retrenchment that is anticipated in today's statement may prove infeasible.

Thursday, November 22, 2012

The fragility of the economy in the Eurozone remains a concern - regardless of conditions within the UK itself, there are still some significant downside risks.

Thursday, November 08, 2012

(1) 'The proportion of graduates who reach the new debt write-off point of 30 years increases to 56 per cent' - in other words most graduates will never repay the full amount of their loan. Indeed, 'the average female graduate will pay back just over half of what they borrow, compared with 87 per cent for the average male graduate'. This, of course, means that many (if not most) students are indifferent about the precise level of fees that they are charged, and this in turn incentivises many universities to charge at the cap of £9000. Another implication of this is that the taxpayer ends up having to bear the burden of the unpaid debt, so that the exchequer savings of the new scheme are not as great as might have been hoped. On the assumption that growth raises graduate earnings by 1.5% per year, the exchequer savings amount to £500m per year - which represents a relatively minor reduction in the public sector deficit.

(2) The paper does not produce revised estimates of the rate of return to higher education. It does point out that the average graudate 'will in futre make repayments totalling £25830 over their lifetime - an increase of 52%' compared with the system that existed before 2012. Meanwhile, 'the average student enjoys an increase in cash support during their degree of some 12 per cent, amounting to £19580 in total'. For some students at the margin, the rate of return to higher education has presumably fallen to such an extent that the investment is no longer worthwhile.

Chowdry, H., Dearden, L., Goodman, A., & Jin, W. (2012). The Distributional Impact of the 2012-13 Higher Education Funding Reforms in England* Fiscal Studies, 33 (2), 211-236 DOI: 10.1111/j.1475-5890.2012.00159.x

Thursday, November 01, 2012

Thursday, October 25, 2012

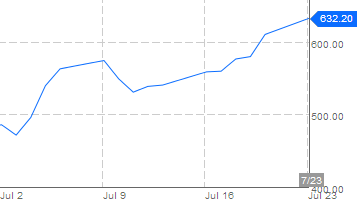

There remain uncertainties in the economic environment that suggest that the celebrations need to be tinged with some caution. But Mario Draghi's announcement of the European Central Bank's new stance has been helpful, and interest rate spreads in Spain, Italy and Portugal have fallen markedly - and stayed down. They are still too high for comfort, but the position is markedly more encouraging than it was just 6 weeks ago.

Sunday, September 23, 2012

Wednesday, September 12, 2012

Thursday, September 06, 2012

Nevertheless, the new initiative is a major step forward. It had been anticipated by the markets - the interest rate spreads for countries such as Spain and Italy had already fallen dramatically over the last day or so. In itself, this is a welcome outcome, though the spreads still have a long way to fall.

Friday, August 24, 2012

Meanwhile, productivity in the energy sector - where North Sea reserves are rapidly being depleted - has declined. In this context, driving the UK towards sustainable productivity growth is likely to be a challenge.

Investment in physical and human capital, and policies to foster innovation are conventional cures for productivity malaise. Business investment requires access to finance and also requires confidence that demand will grow into the future.

Continued uncertainty about the macroeconomic outlook - and especially about the outcome of the Euro crisis - is, in the absence of a quick resolution, likely to continue to frustrate hopes of a speedy return to healthy productivity growth.

Abigail Hughes, & Jumana Saleheen (2012). UK labour productivity since the onset of the crisis - an international and historical perspective Bank of England Quarterly Bulletin, 138-146

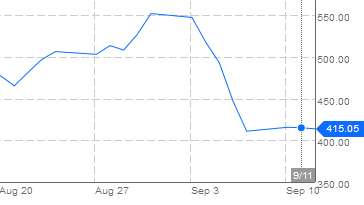

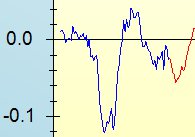

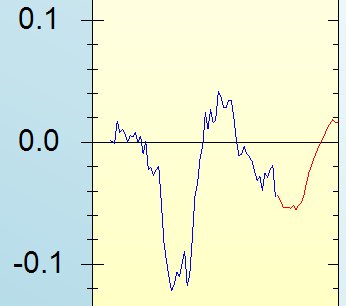

It is clear that the medium term outlook remains grim. While the growth rate has by now pretty much bottomed out, these data suggest that the return to a positive rate of growth will not come until late next year.

Of course, such a simple model cannot take into account the plethora of uncertainties surrounding the Euro crisis and its ramifications for economic conditions in our major export markets. The risks there, however, remain predominantly on the downside.

The public finance data for July were disappointing; a prolonged recession is likely to mean dampened government revenues and increased government spending on welfare, so, while output struggles to recover, the outlook for deficit reduction is poor.

Tuesday, July 24, 2012

A rescue package for an economy the size of Spain's will inevitably put strain on other European economies. With this scenario as the backdrop, the news that Moody's credit rating agency has announced negative outlooks for Germany, the Netherlands and Luxembourg, is unsurprising.

Monday, July 09, 2012

Wednesday, June 20, 2012

The relatively strong productivity growth in some other economies - particularly in southern Europe - may well be due to the rapid increase in unemployment, with relatively low productivity workers losing their jobs. But the sluggish growth productivity in the UK has to be a source of concern. It reflects, in part at least, a lack of confidence in future prospects, and a consequent failure of businesses to invest.

While demand factors likely dominate the economic situation in the short term, in the longer term supply factors are clearly of paramount importance. The supply side issues that underpin the underperformance of the UK in international comparisons of productivity therefore warrant urgent attention.

Abigail Hughes and Jumana Saleheen (2012). UK labour productivity since the onset of the crisis — an international and historical perspective Bank of England Quarterly Bulletin, 52 (2), 138-146

Arguing in favour of a fiscal injection that would, in the short term, serve to widen the government's budget deficit does of course represent a tough political challenge. But the evidence is clear that such an injection would serve to promote growth. And, with inflation now back within the Bank of England's target range, the argument that it would stoke inflation is increasingly difficult to sustain.

Karel Mertens and Morten Ravn (2012). A reconciliation of SVAR and narrative estimators of tax multipliers Cornell University Working Paper

Monday, June 18, 2012

Friday, June 15, 2012

Faced by such a dismal economic picture, the success of these initiatives will depend on the extent to which extra liquidity will translate into extra economic activity. With gloomy prospects and low levels of confidence about the medium term outlook, businesses may not consider this to be the best time to invest. Pushing 'Plan A' - expansionary monetary policy combined with fiscal retrenchment - to the limit is all well and good. But in a liquidity trap monetary policy alone cannot deliver growth.

Much remains to be done, however. A key failing of the banking system is that it is insufficiently competitive. The players in this industry are too large. Given the extent to which economies of scale prevail, it is easy to understand how this situation has come about. Nonetheless, other industries are subject to regulation to ensure competition, and banking needs to be no different. The White Paper makes reference to the forthcoming divestment of part of Lloyds Banking Group, and points out that this is an opportunity to increase competition. It is indeed such an opportunity, but I suspect that, beyond hoping that this will be so, the need for much more aggressive regulation remains acute.

Monday, June 11, 2012

The initial response of the markets has not been particularly favourable. The spread between Spanish and German interest rates on 10 year loans has once again widened to above 5 percentage points, after falling over the last 10 days. The spread for Italy, widely seen as being the next country to be affected by this contagion, has also risen - in this case passing through the 4.5 percentage point mark. The key test will be the next bond auctions in Spain, scheduled to take place next week.

Friday, April 27, 2012

Next came the GDP figures for the first quarter of this year. These indicate that the economy slipped back into recession, with negative growth being observed for the second successive quarter. The overall growth rate in the first quarter was -0.2%, but this figure tends to conceal experience that differs quite markedly across industries. The construction sector, in particular, performed badly, with a growth rate of -3.0% in the first quarter. Services (which comprise a high proportion of total output in the economy) grew, but by only 0.1%. So the news on GDP has been very disappointing (albeit not surprising to readers of this blog).

More encouraging news has come in the form of a boost to consumer confidence, with the Nationwide reporting a marked jump in its indicator.

Yet, while the first quarter of this year has been one in which there are a few (very patchy) signs of life in the economy, the wider environment remains one in which there are many uncertainties and downside risks. Spain has become a renewed source of concern - the spread between Spanish and German interest rates increased in early April and shows no sign of coming down any time soon - this spread currently stands at more than 4 percentage points. At the beginning of March it was 3, and at the end of March it was 3.5. Meanwhile, the unemployment rate in Spain has risen to more than 24%, presenting a severe challenge to government policy and raising questions about the sustainability of the country's debt - which is already approaching 80% of GDP. Parallels with Greece are starting to be drawn - but Spain's economy is much bigger than that of Greece, and its difficulties are likely therefore to have larger ramifications elsewhere.

The overall position therefore remains one that is best described as gloomy.

Monday, March 19, 2012

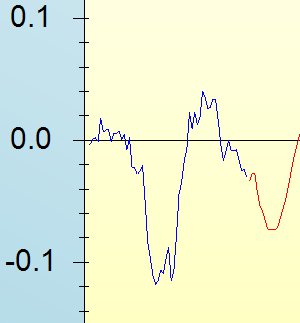

The forecasts produced by my model do not back this up - indeed they suggest that we may need to wait till the first half of 2013 before we see growth re-establishing itself. After a slight upward blip (round about now), the model predicts that the rate of growth of output will dip back down. Once growth resumes, it rises quite sharply to around 2% per year.

The forecast is, of course, based only on limited information - about industrial output. It is not sophisticated enough to include information about policy shocks - changes in the behaviour of the European Central Bank, the successful Greek debt renegotiation, and so on. It therefore looks, to me, to be a pessimistic forecast. But it may serve, if nothing else, to remind us that times are still uncertain, and there remain some serious downside risks.

Wednesday, February 29, 2012

Some evidence on this issue comes from the work of Mathias Trabandt and Harald Uhlig, who calculate ‘Laffer curves’ for a variety of countries. Laffer curves plot tax revenues against the tax rate. Tax revenues are low when the tax rate is low for obvious reasons; they are also low when the tax rate is high because there is then a strong disincentive effect. The Laffer curve therefore takes on an inverse U shape, low at the extremes and peaking at some non-extreme rate of tax. For the UK the Laffer curve peaks at an income tax rate somewhere between 50 and 60 per cent. This suggests that the current top rate is about right.

Tuesday, February 21, 2012

The current generation of macroeconomic models is based on building blocks of utility maximising individuals and profit maximising firms, all with the ability to make sensible forecasts of the future evolution of the economy and with the ability to adjust their behaviour in line with the current and expected future economic environment - which includes, amongst other things, government policy. There is a lot going on in these models - just as there is a lot going on in the real world. In many cases, the results obtained from these models are the same as those that emerge from the textbook models. In some cases - unusual cases, perhaps - they are not. Since we live in unusual times, it is not altogether ludicrous to consider some of these unusual cases.

A recent paper does just that. It asks the question: in a world where sovreign debt is approaching the limits of sustainability, does fiscal policy work in the same way as textbook models say it should? The answer is: it may do, it may not. Under certain (extreme) circumstances it may even be the case that austerity can stimulate the economy. Under more plausible scenarios, however, the results of the paper emphasise the 'benefit of delaying fiscal adjustment until after the economy has recovered from the worst of the initial recession'

Giancarlo Corsetti, Keith Kuester, Andre Meier and Gernot J. Mueller (2012). Sovreign risk, fiscal policy, and macroeconomic stability International Monetary Fund Working Paper

Thursday, February 16, 2012

Meanwhile, consumer confidence has started to rise.

It remains far too early to suggest that a corner has been turned. Future developments in Europe remain unclear. While monetary policy, with renewed quantitative easing, is likely to stimulate the UK's economy, fiscal policy is still restricting growth. And the labour market situation remains bleak; unemployment typically rises for some time after output starts to recover. But, while still very fragile, the overall economic outlook now looks more promising than has been the case for some time.

Wednesday, January 25, 2012

Tuesday, January 24, 2012

It's taken the IMF a while to get it - but they have not been alone in the policy-making community. Hopefully their words will not fall on deaf ears.

Thursday, January 19, 2012

The willingness of employers to hire labour is, of course, determined in large measure by its cost. Youth wages have risen by less than adult wages over the last 15 years, so it is not immediately obvious that this is the source of the problem. The elasticity of the real youth wage with respect to the youth unemployment rate is negative (as we would expect) at around -0.1, indicating that a change in the youth unemployment rate from (say) 10 to 11 per cent would bring about a 10 per cent fall in youth wages. That should help to make young people more attractive to employers. Meanwhile, the elasticity of youth wages with respect to the adult wage is high (at a little over 0.8).

Weakening the link between youth wages and adult wages - making youth wages more responsive to conditions in the labour market specifically for young people - might, over the longer term, help alleviate the difficulties that many young people experience in finding work. Of more immediate concern, many firms lack the confidence to invest in new projects that would expand employment, and, where they do wish to invest, they still often lack the access to finance.

Tuesday, January 17, 2012

Tuesday, January 10, 2012

Goldhaber, D., & Anthony, E. (2007). Can Teacher Quality Be Effectively Assessed? National Board Certification as a Signal of Effective Teaching Review of Economics and Statistics, 89 (1), 134-150 DOI: 10.1162/rest.89.1.134

Thursday, January 05, 2012

This evidence is particularly interesting in the context of yesterday's speech by David Willetts, Minister of State for Universities and Science, in which the goal of 'inviting proposals for a new type of university with a focus on science and technology ... (with) ... no additional government funding' was announced. There is, surely, a role to be played by the private sector in higher education. The case in favour of for-profits is not so clear.