Following encouraging noises, the Troika rejected the Greek proposals, concerned that they rely too heavily on tax hikes and not enough on spending cuts. The prevarication of the Troika is, of course, understandable given its composition. The Greek government is seeking to negotiate with a group of three separate bodies, which is tough enough in itself, but the European Commission serves as representative of the 27 member states of the Union (excluding Greece itself). Negotiating with a coalition of this complexity presents a unique set of hazards, particularly in an age when a raised eyebrow is enough to go viral in the twittersphere.

The Troika’s concern about tax hikes versus spending cuts is, in itself, interesting, and it is likely to come from two sources. One is the influential work of Alberto Alesina, who presented a case to European Finance Ministers some 5 years ago arguing that government spending cuts can (in contrast to tax hikes) stimulate an economy. This doctrine of ‘expansionary contraction’ has been largely discredited since, notably in work done by the International Monetary Fund and also in Alesina’s own further investigations. Nevertheless, the ideas seem to be sticking in people’s minds, possibly because (in spite of all the evidence) the fantasy that deficits can be removed without pain is superficially appealing. The second source of the Troika’s concern is perhaps more serious, in that it has a more rational foundation. It is a deficit of trust. Based on track record, there is simply too much scepticism that Greece will succeed in bringing in the extra tax revenues. It is difficult to see how that trust deficit can be closed, at least without entailing a fundamental loss of Greek sovereignty.

Following the Troika response to the Greek proposals, Greek Prime Minister Alexis Tsipras announced a referendum to be held on Sunday. This is, of course, after the date at which the loan repayments are due and means that these repayments will be, at least, deferred. The Greek government is advocating a ‘no’ vote in the referendum – that is, a rejection of the austerity measures that the Troika is seeking to impose. Such a vote would likely lead to loss of support from the European Central Bank, forcing Greece out of the Eurozone and (surely?) also out of the European Union. A ‘yes’ vote would compromise the ruling Syriza party, generating considerably political uncertainty.

With Greece outside the Eurozone, it would have to set up its own currency – a new drachma. The value of this currency would quickly depreciate, leading to inflation in Greece as imports become more expensive. The inflation would erode the value of the Greek debt, in effect representing a partial default on that debt. In addition, it is possible (likely, even) that there would be an explicit default on some part of the amount that Greece still owes to its creditors.

The Troika has been reluctant to discuss debt relief as part of the deal it has been seeking to negotiate with Greece, but the reality is that some relief, in one form or another, is inevitable. There is no real reason not to discuss it. For sure, there are moral hazard issues – debt relief on one occasion makes recalcitrant behaviour in the future more likely – but we are where we are, and the negotiators need to acknowledge and respect that.

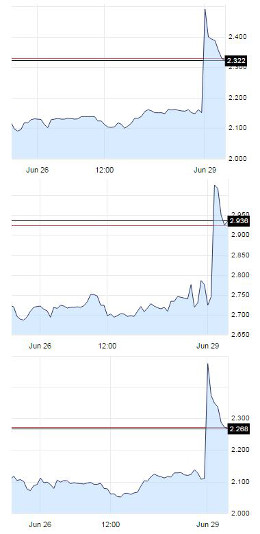

The impact of the last week’s events on the markets has been noteworthy. The yield on Greek 10 year bonds fell sharply when a deal looked imminent. When, with the announcement of the referendum, it became clear that talks had broken down, the yield rose sharply again. This is a textbook case of how news affects market returns.

A major concern for countries in Europe other than Greece is the extent to which a default (of whatever form) would have adverse effects on other economies within the Union. Creditors may have insulated themselves from excessive exposure to a default, at least to some extent, over the last couple of years. The response of yields in Italy, Portugal and Spain (below) is not altogether encouraging, however. The degree of contagion may be less than it would have been in 2012, but the potential is still there for Greek default to have a severe impact on economies whose recovery from severe economic recession remains vulnerable.

Meanwhile, over recent weeks people have been withdrawing their money from Greek banks, concerned by several possibilities – including the imposition of restrictions and also the possibility that their safe currency (euros) might be replaced by a new local currency (drachmas) of lower value. Such action, while perfectly rational, rapidly becomes a self-fulfilling prophecy. Consequently Greek banks will be shut for the whole of this week, at least, and restrictions have been imposed on ATM withdrawals. Times are tough, and the liquidity that is needed for the normal functioning of an economy is seriously restricted now.

To come so close to reaching a settlement and then to fail betrays some pretty dismal negotiating skills on both sides. The Troika is particularly to blame for its intransigence – though this comes partly from its own cumbersome composition. It has succeeded in appearing willing to trample over democracy in order to achieve technocratic solutions, and this can only have an adverse effect on the way in which EU institutions are regarded in the wider European community. Meanwhile, while the Greek government has made all the compromises, they have failed to acknowledge and address the trust deficit, failing also to recognise and allow for the Troika’s intransigence; put simply, they have misjudged their own position in the negotiation.

Last night it appeared as though President Obama was working behind the scenes to secure a solution – pressing Angela Merkel to ‘make every effort to return to the path that will allow Greece to resume reforms and growth within the Eurozone’. Such a statespersonlike intervention was sorely needed, and it is to be hoped that the President’s intervention can help the negotiators on both sides see this through.