As well as providing incentives to save more, policy has been aimed at lengthening working lives. The age at which workers qualify for the state pension is being raised gradually, and in 2011 the concept of a default retirement age was scrapped.

These two solutions - saving more and working longer - are often seen as the only two options available in paying for the increased burden of an ageing population. But there may be a third.

If productivity were to rise, the additional output produced by those in work could be used to pay for some of the extra cost burden - in terms of both care and pensions - implied by ageing. In the long run, this could be done through private savings and insurance. In the short and medium term, however, it would involve some redistribution from the generation of working age people to that of retirees. That would need to be done through the tax system. (That is a transitory and technical requirement, not an expression of a preference for solutions from the political left.)

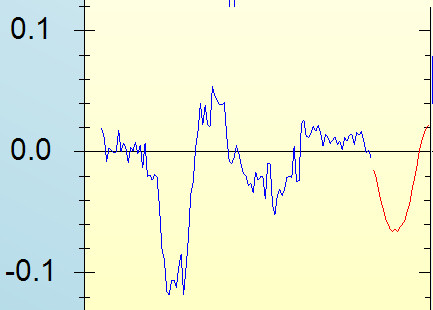

Suggesting increased productivity as a solution may appear curious at a time when the economy is still suffering from a stagnation in productivity - the so-called productivity puzzle. But there is reason to believe that productivity growth might come back.

If ageing is one challenge that society has to learn to face, another is the rapid advance of technology. Some researchers predict that almost a half of all jobs are at risk of becoming defunct owing to the steady march of the robots. If true, adapting to that is certainly a challenge - though past experience suggests that jobs morph as technology advances. What is certain is that rapid technological advance should bring about massive changes in productivity - why else would the technology be adopted?

We certainly need to plan for longer lives through saving more and working longer. But, faced by the two challenges of ageing and rapid technological change, we might just find that one can become a solution to the other. And - to reiterate - fully to take advantage of this opportunity when it comes, we must be lithe in our thinking around what is acceptable in the arena of taxation and redistribution.